Does it pay to be really good?

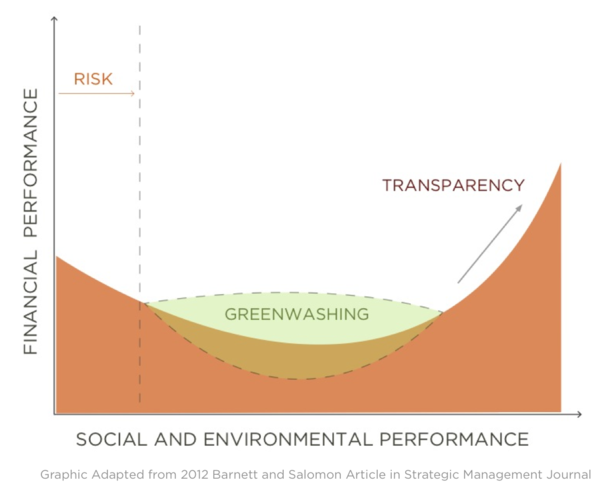

The Living Building Challenge presented this image to show the business case for materials transparency.

So who are the attributed Barnett and Salomo and what data back up this diagram?

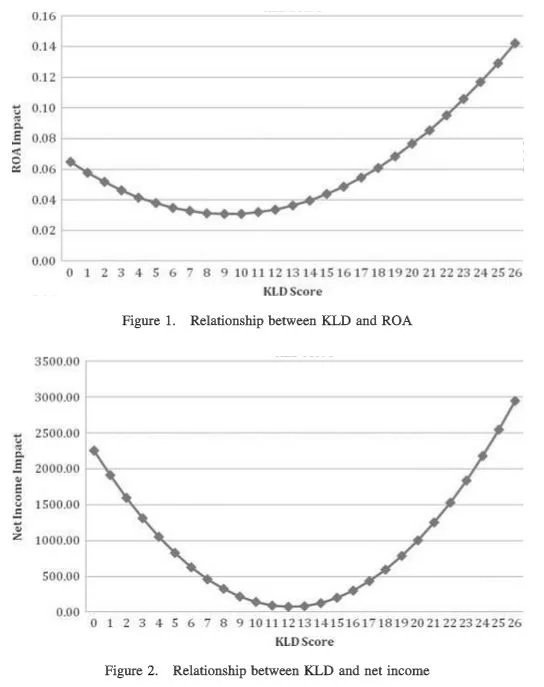

he study looked at 1,214 publicly traded firms and 4,730 firm year observations from 1998-2006. Kinder, Lydenberg, and Domini (KLD), an independent company rates firms on thirteen individual social performance criteria. Seven of the key attributes include community, corporate governance, diversity, employee relations, environment, human rights and product, each firm receiving integer scores based on their strengths and weaknesses. The other six attributes relate to whether the firm participates in a socially controversial business like gambling, military, nuclear power, alcohol/drugs sale etc. The KLD scores were translated to a scale from 0 to 27 by the researchers.

Barnett and Salomon's statistical analyses found that return on assets (ROA) positively correlated to the prior year's ROA, the firm's net income, and their investment in advertising. ROA also increased when social performance increased, but in a U-shape. ROA negatively correlated with larger debt burdens and greater R&D intensity. In general, service-based industries performed better than manufacturing industries. Net income correlations also were found to be strongly related to the prior year's net income and the current year's net income. At first the correlation between KLD score and net income was unclear, but once service and manufacturing industries were separated, the same U-shaped correlation was found.

Here are the actual U shapes:

The U shape shows us a few things. First, that the most profitable firms are both those which have the very least investment in social responsibility and those which have the greatest. A company that makes only the most minimal effort to invest in socially responsibile efforts loses financially. Only firms that make great strides are able to differentiate themselves in the eyes of stakeholders. The key is when firms are able to translate social performance into improved stakeholder relations. Only then can a firm transform social investment into positive finanacial returns.